Let’s talk about the February 2025 real estate market in Toronto. If you were hoping for a rollercoaster of shocking twists, I regret to inform you: this month’s market update is more of a slow-moving carousel. Homebuyers still hold the power, sellers are playing the patience game, and mortgage rates are still anticipated to decline.

February handed homebuyers in the GTA a big, juicy gift: options. Lots of them. Listings are up, sales are down, and if you’re in the market to buy, you’ve got negotiating power on your side. Sellers, on the other hand, might be feeling like they showed up to a speed dating event only to realize everyone else is just here for the free appetizers. There’s interest—but not a lot of commitment.

Even with all this choice, many potential buyers are still stuck on the sidelines because of—you guessed it—mortgage rates. Affording a home in Toronto right now is kind of like trying to run a marathon with a backpack full of bricks. Sure, it’s possible, but it’s going to hurt. The good news? There are whispers of lower borrowing costs in the coming months, which could finally make homeownership a bit more doable without the need for a lottery win.

Beyond affordability, there’s another reason buyers are hesitating: economic uncertainty. Between trade relationship drama with our friends south of the border and general financial unease, many would-be buyers are holding off to see how things shake out. It’s kind of like waiting until after the credits roll to see if there’s a post-credit scene that changes everything.

If mortgage rates keep dropping, and if our economic outlook gets a bit clearer, we could see a busier second half of the year. But for now, buyers are cautious, sellers are adjusting expectations, and everyone is waiting for that moment when things finally shift.

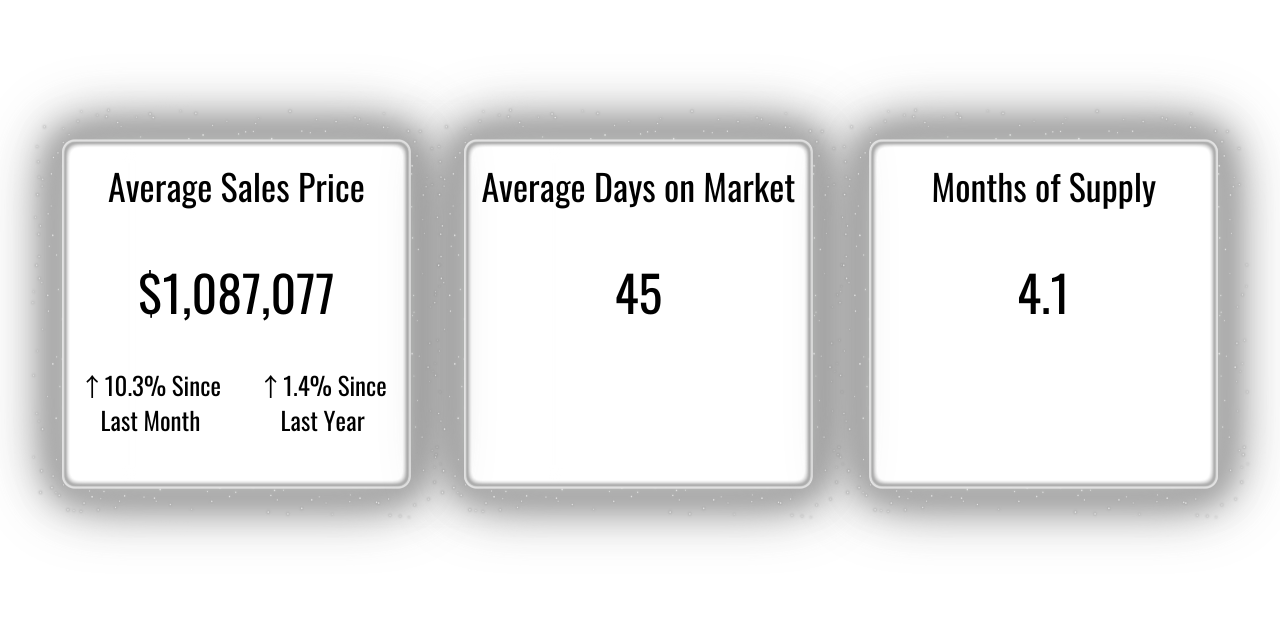

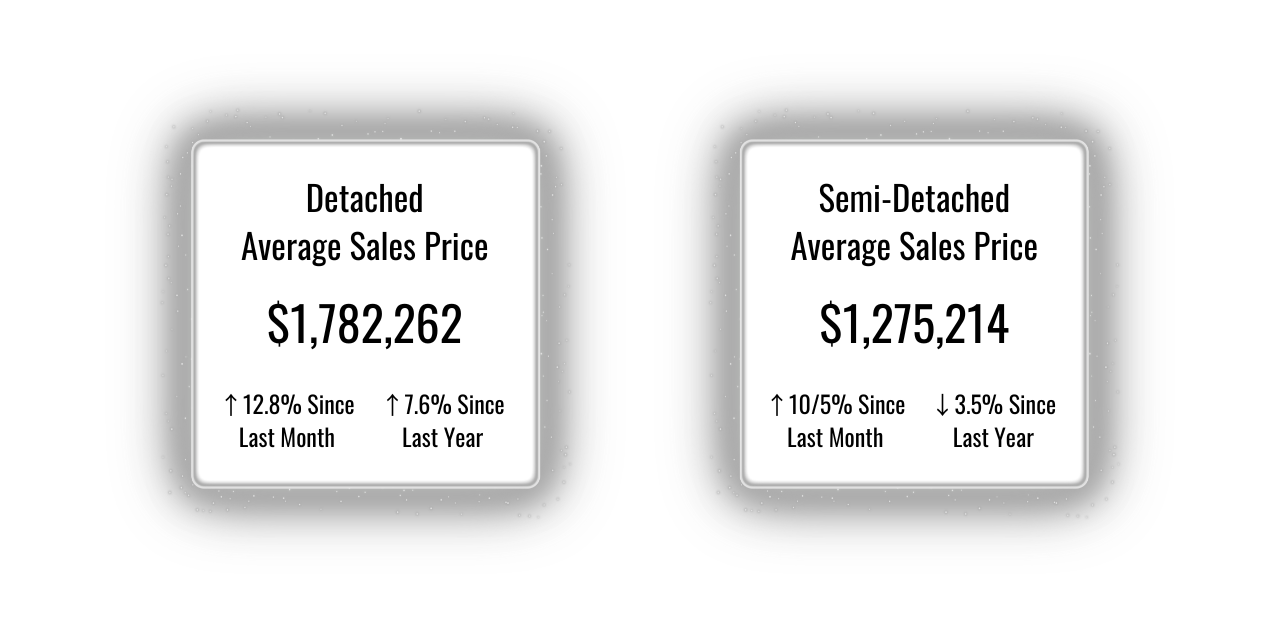

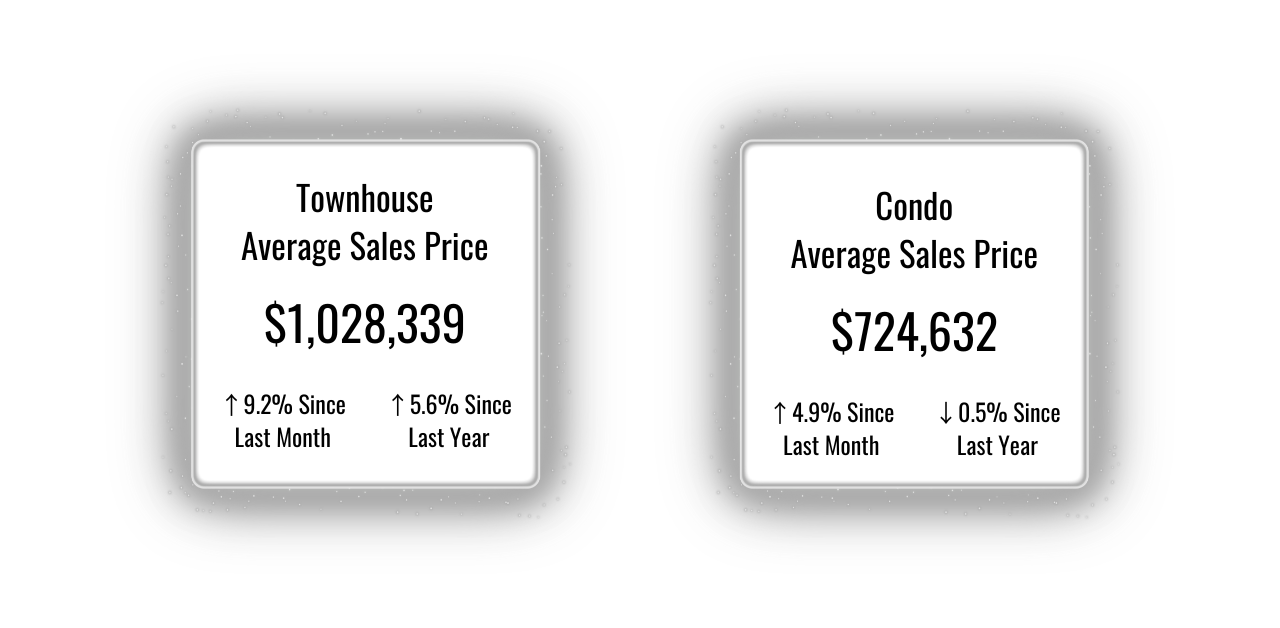

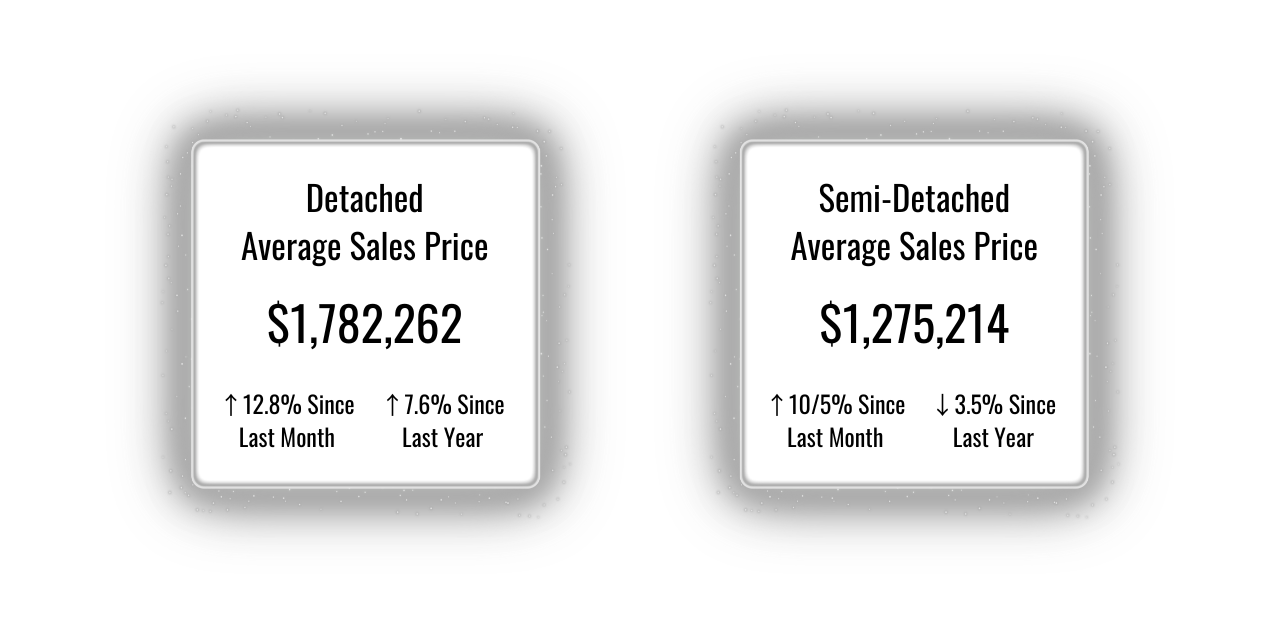

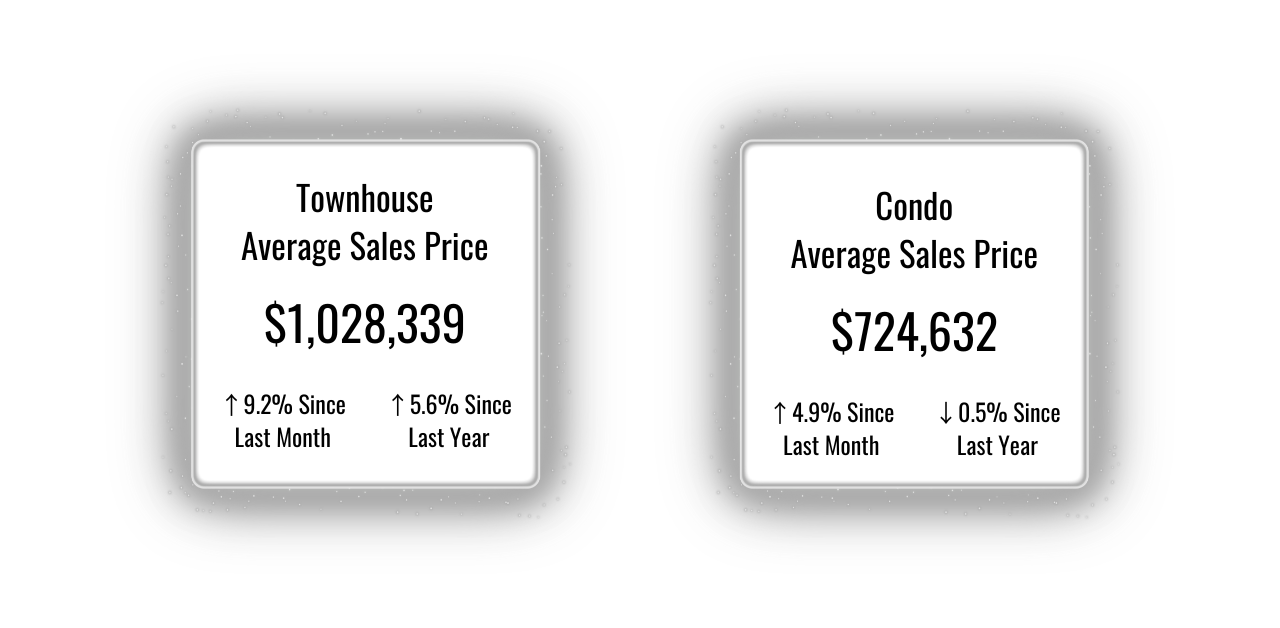

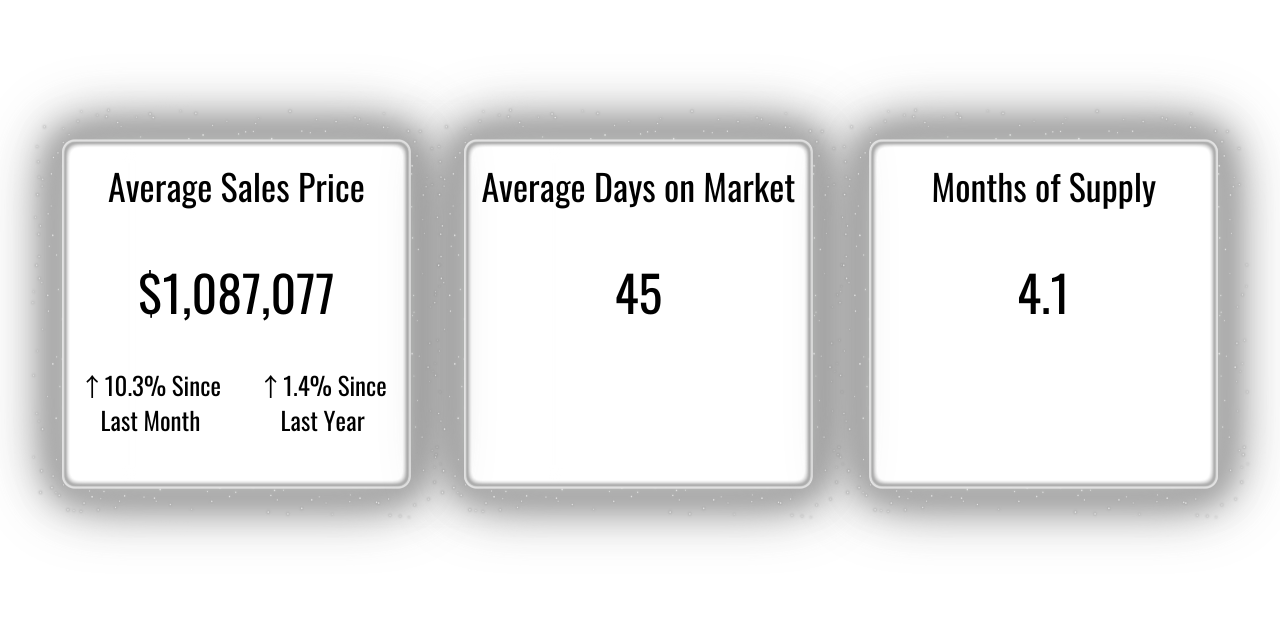

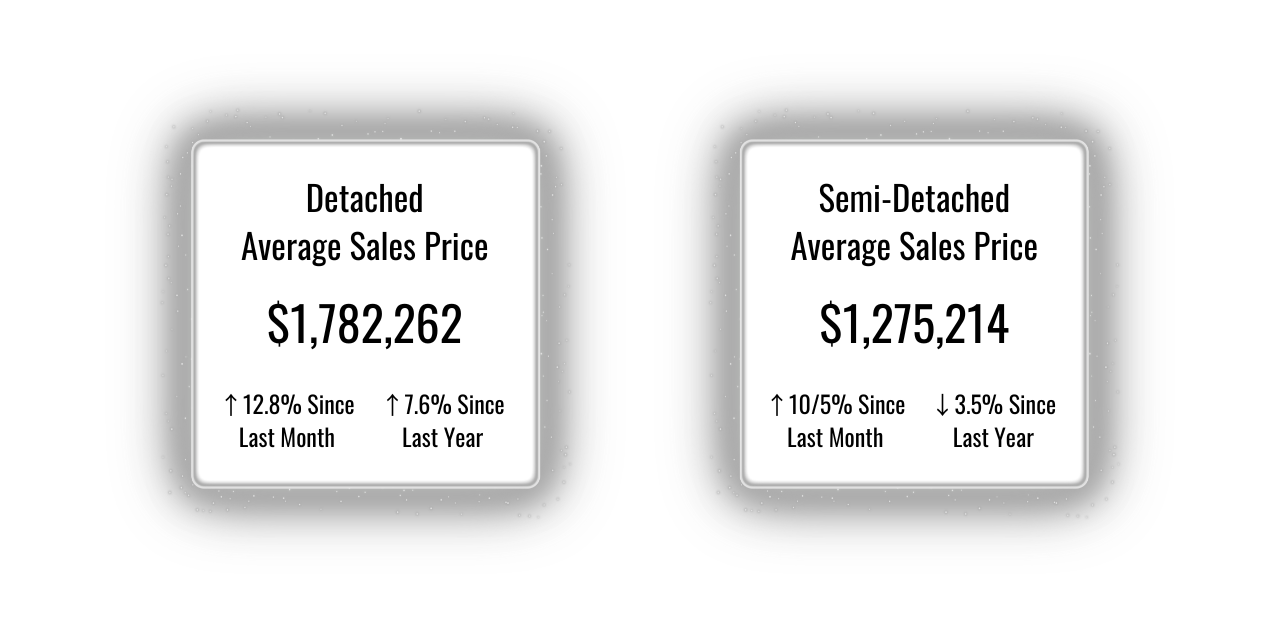

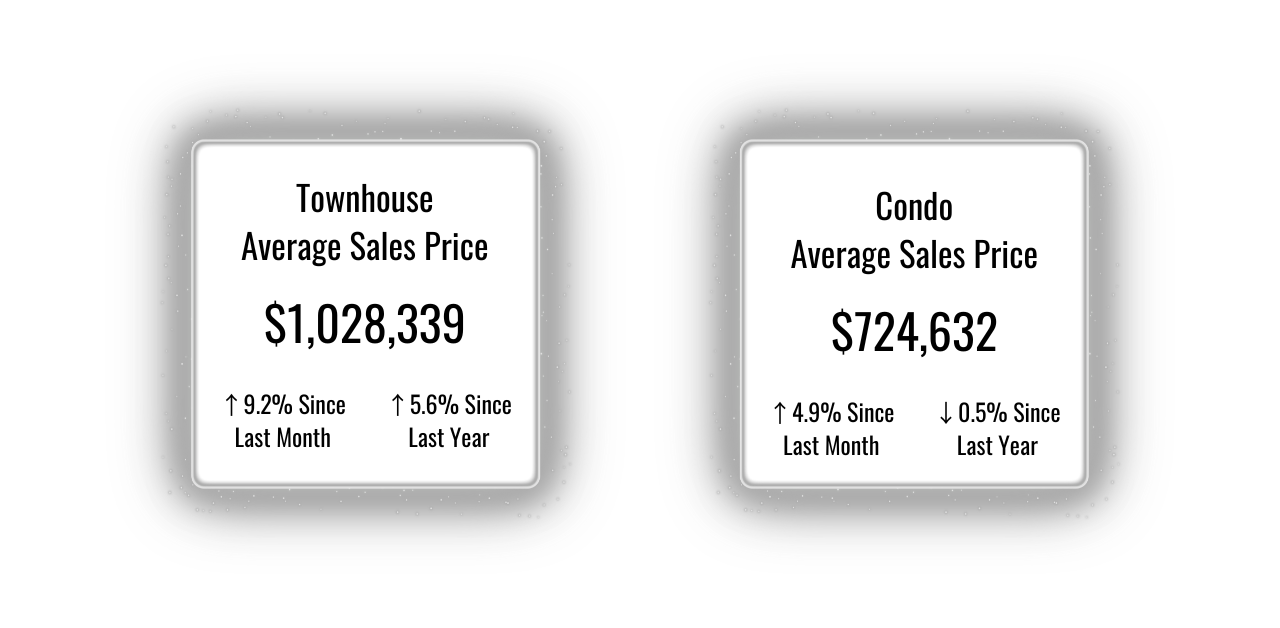

Here are the most recent Toronto numbers...

If you’re thinking about buying or selling, now is a great time to strategize. Let’s talk about your goals and how we can make the market work for you.