Here’s the scoop on the Toronto real estate scene in October 2024: it’s definitely waking up from its long nap. And why? Because the cost of borrowing is finally going down. It seems that all those buyers who’ve been lurking in the shadows, holding off until the rates started to dip, finally decided it was time to make a move.

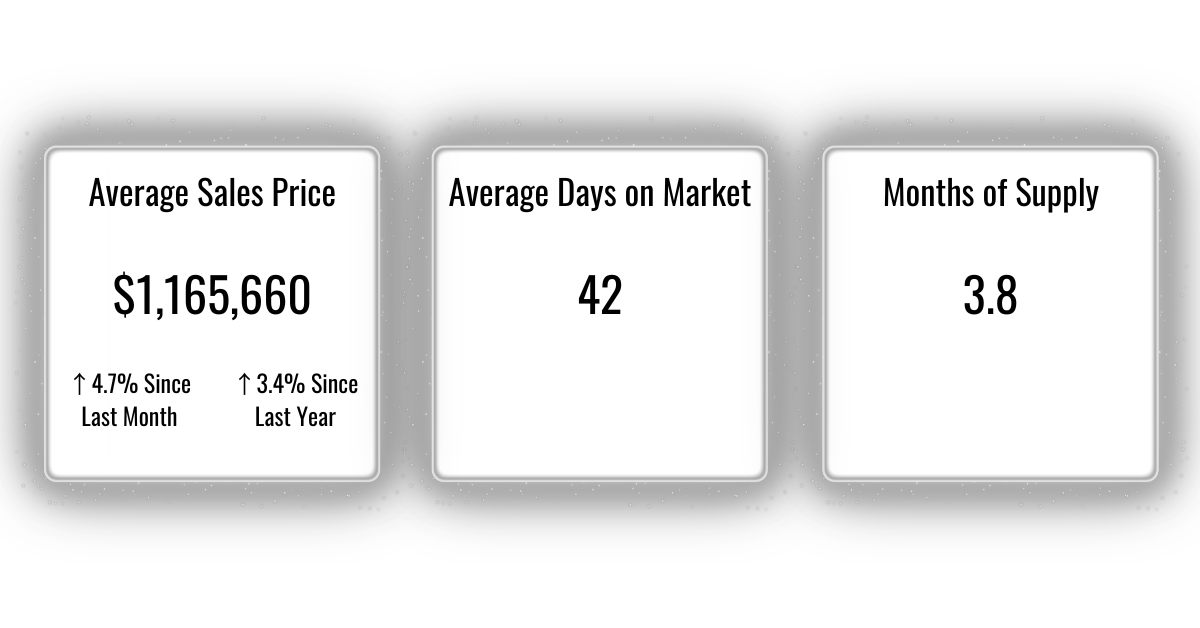

More people selling, more people buying—it’s all coming together in the Greater Toronto Area (GTA). But here’s the twist: even though we saw more listings this October than last, the demand from buyers is still keeping the market tighter than it’s been in a while. Translation? Homes aren’t exactly sitting around for long. This tightening of the market has kept prices fairly steady compared to the past month. However, there’s a bit of a catch: while the overall price tag on a home is up from last October, the MLS® benchmark price—the one that’s supposed to reflect the typical home—dropped slightly year-over-year. Basically, prices are up, but the actual value compared to last year is a bit of a mixed bag.

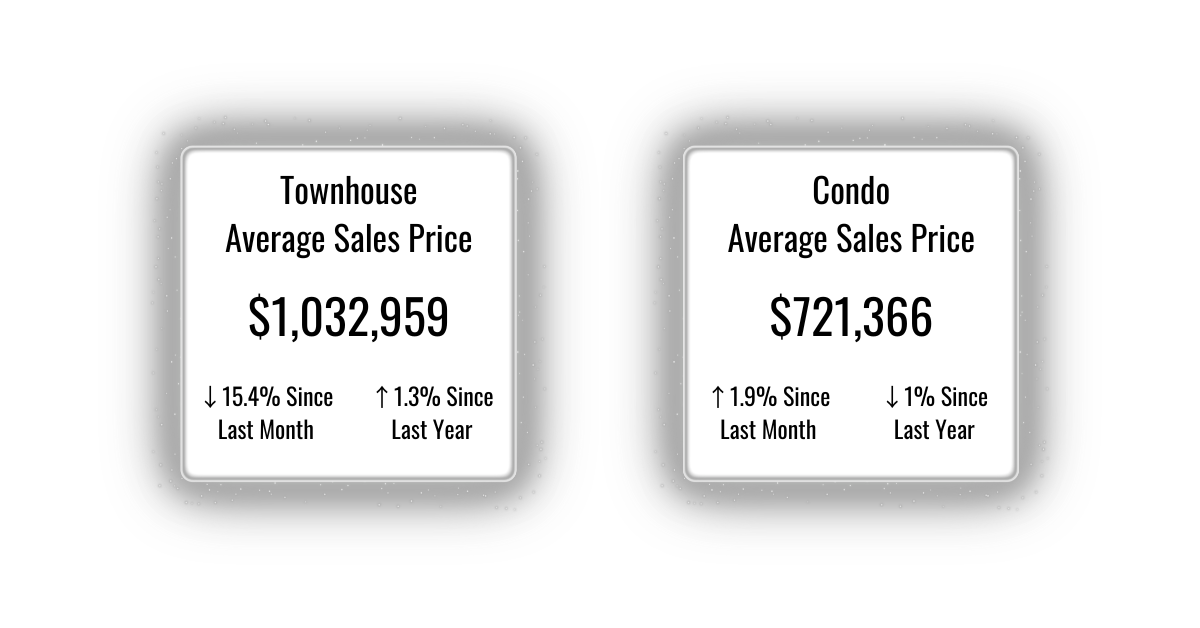

Now, let’s talk inventory. There’s more choice for buyers right now, but that doesn’t mean this is going to last forever. If we keep welcoming new residents without building enough new homes, we’re looking at a market that’s going to heat up, probably as early as this spring. That means if you’re in the market now, you might still find decent options. But don’t get too comfortable—this current level of selection might not last.

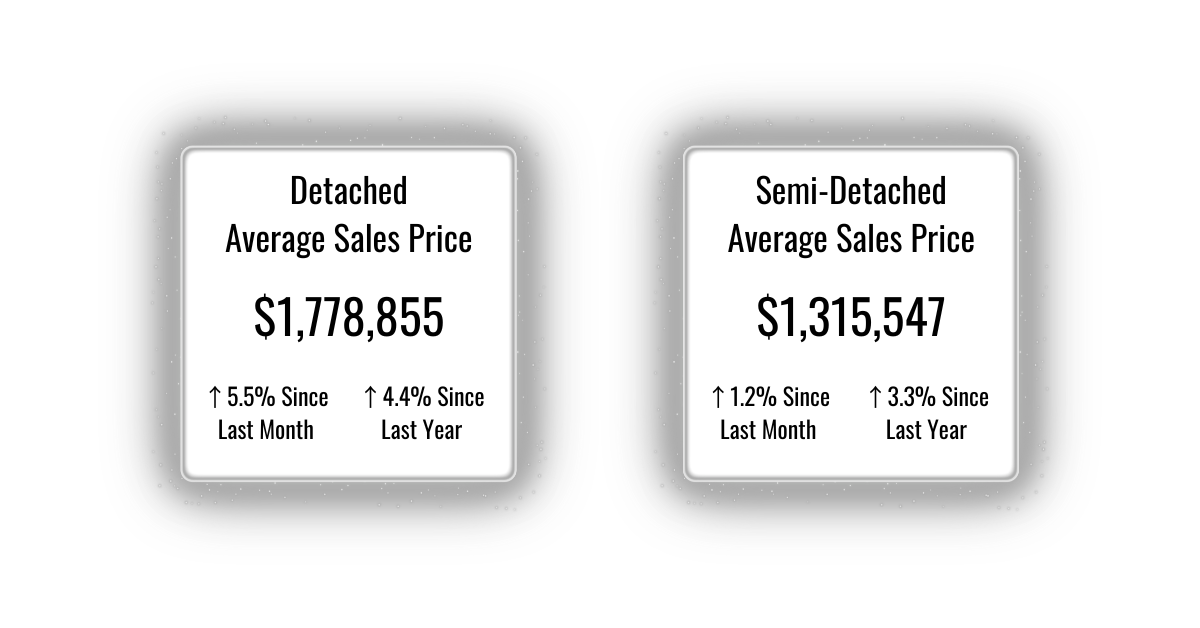

One thing that’s making waves on the policy side is the Conservative Party’s recent pledge to cut the GST for new homes priced under $1 million. The goal is to give first-time buyers a bit of a break—an important move, especially with the average home price still sitting north of a million in the GTA. But here’s the thing: a hard cutoff at $1 million doesn’t quite capture the reality here. To really help buyers, the policy needs to reflect the actual market, where homes don’t magically drop in affordability at the million-dollar mark. Extending the rebate up to homes priced at $1.5 million would be more realistic.

So, what’s the takeaway? October saw more action, and with rates easing, things could get even busier. Prices aren’t exactly going sky-high, but they’re staying solid, with just enough inventory to keep it interesting for now. If you’re thinking about jumping into the market, this might just be your moment—because once that spring heat hits, those choices could shrink fast.

More people selling, more people buying—it’s all coming together in the Greater Toronto Area (GTA). But here’s the twist: even though we saw more listings this October than last, the demand from buyers is still keeping the market tighter than it’s been in a while. Translation? Homes aren’t exactly sitting around for long. This tightening of the market has kept prices fairly steady compared to the past month. However, there’s a bit of a catch: while the overall price tag on a home is up from last October, the MLS® benchmark price—the one that’s supposed to reflect the typical home—dropped slightly year-over-year. Basically, prices are up, but the actual value compared to last year is a bit of a mixed bag.

Now, let’s talk inventory. There’s more choice for buyers right now, but that doesn’t mean this is going to last forever. If we keep welcoming new residents without building enough new homes, we’re looking at a market that’s going to heat up, probably as early as this spring. That means if you’re in the market now, you might still find decent options. But don’t get too comfortable—this current level of selection might not last.

One thing that’s making waves on the policy side is the Conservative Party’s recent pledge to cut the GST for new homes priced under $1 million. The goal is to give first-time buyers a bit of a break—an important move, especially with the average home price still sitting north of a million in the GTA. But here’s the thing: a hard cutoff at $1 million doesn’t quite capture the reality here. To really help buyers, the policy needs to reflect the actual market, where homes don’t magically drop in affordability at the million-dollar mark. Extending the rebate up to homes priced at $1.5 million would be more realistic.

So, what’s the takeaway? October saw more action, and with rates easing, things could get even busier. Prices aren’t exactly going sky-high, but they’re staying solid, with just enough inventory to keep it interesting for now. If you’re thinking about jumping into the market, this might just be your moment—because once that spring heat hits, those choices could shrink fast.