So, you want to know what's happening in Toronto's real estate market as we roll into September 2024? Well, buckle up because it's been an interesting ride. August didn’t exactly bring a fireworks display to the Greater Toronto Area (GTA) housing scene. In fact, home sales took a bit of a dip compared to this time last year. But, like a classic Toronto weather forecast, there’s a mix of sunshine and clouds on the horizon.

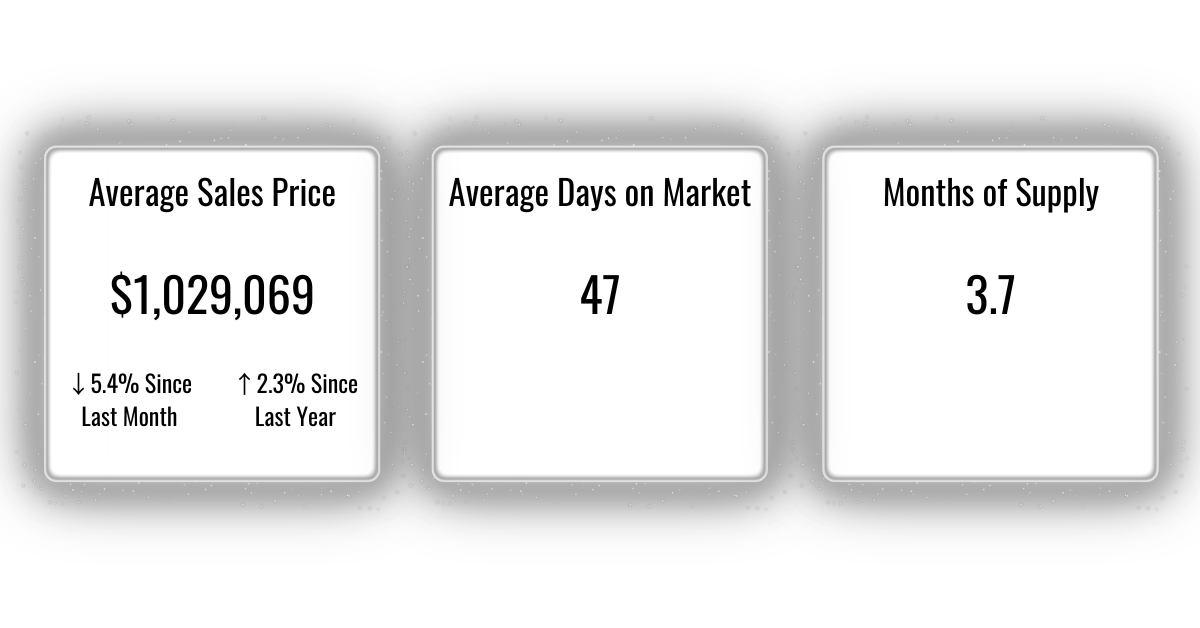

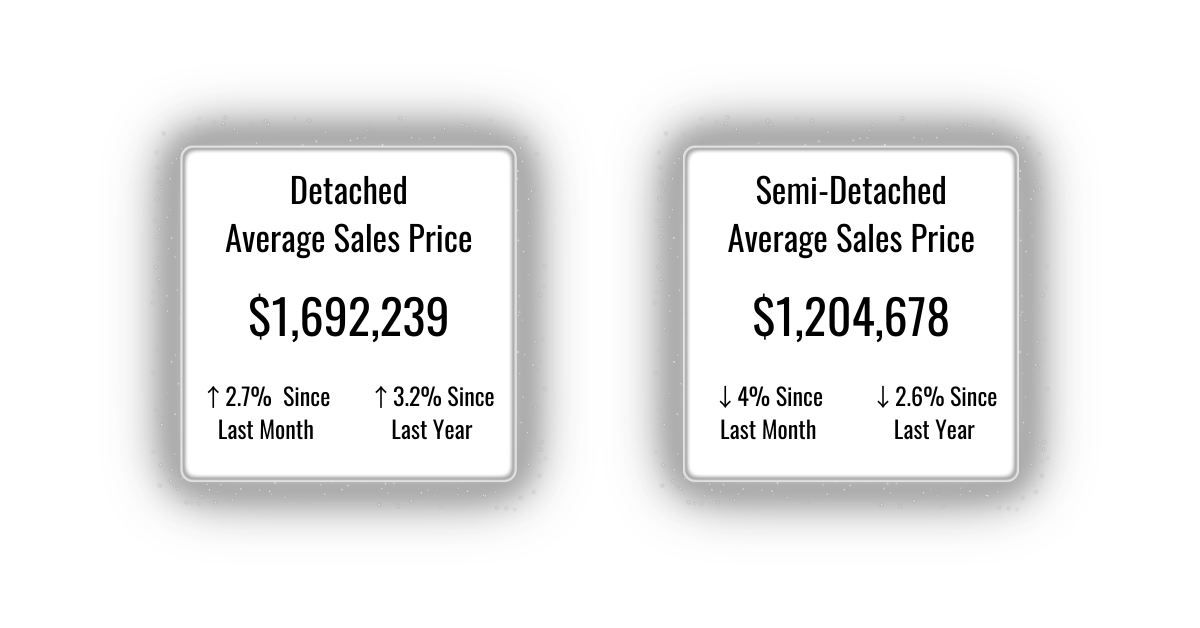

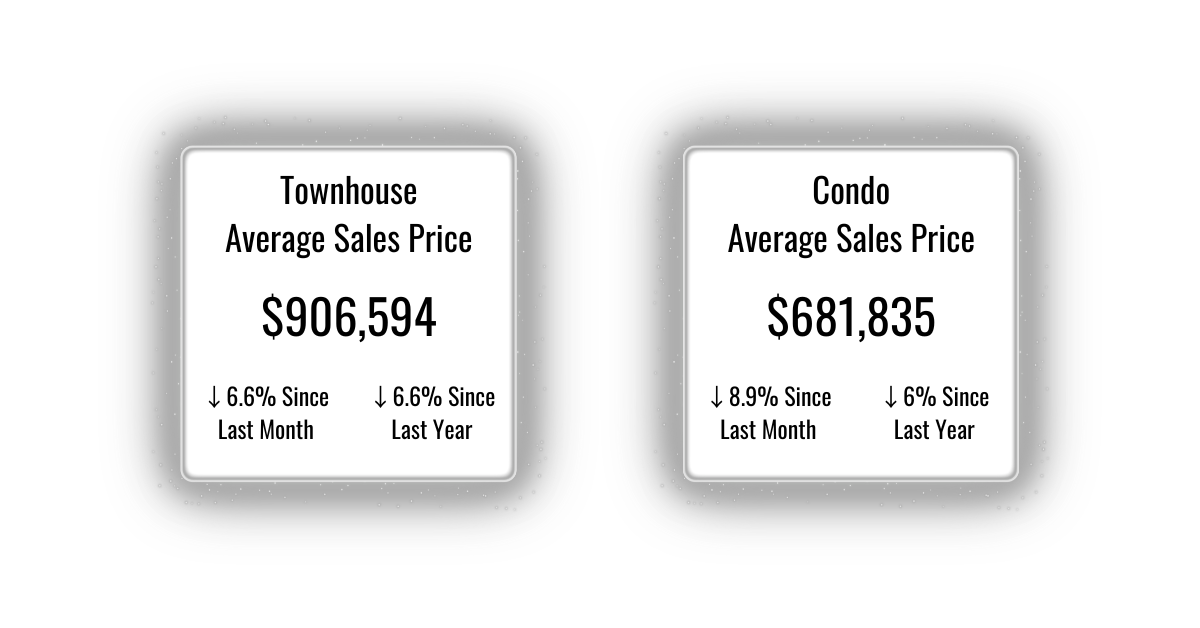

Let’s start with the facts: yes, home sales are down. But does this mean the market is crashing, burning, or otherwise imploding? Not quite. The number of new listings crept up a little, which means more homes are up for grabs. The market's staying well-stocked with options, so if you’ve been browsing, you might have noticed that the landscape looks pretty similar to last month. Prices? They’ve edged down a bit compared to last year. Nothing dramatic—just a little nudge lower.

You might be thinking, "Okay, so fewer people are buying, more homes are being listed, and prices are just… hanging out?" Pretty much. The reality is that the current market is all about balance—lots of homes on the market, but buyers aren’t exactly rushing in like it’s Black Friday. Sellers are adjusting expectations, and prices are reflecting that.

But here’s the twist: the Bank of Canada dropped a rate cut on September 4th, which is like tossing a pebble into a still pond. It’s not going to create a tidal wave immediately, but it’s going to ripple through the market in some interesting ways. Lower rates mean better affordability, especially for those clutching their variable-rate mortgages like a life raft. First-time buyers, this might be your moment. With borrowing costs set to trend downward for the rest of this year and into the next, we could see a new wave of buyers dipping their toes back in, particularly in the condo market.

Now, just because we might see more buyers entering the scene doesn't mean we're about to witness a feeding frenzy. Even with demand picking up, there’s still plenty of inventory out there. So, while more buyers might jump in as mortgage rates become more attractive, they’re not going to gobble up everything overnight. We’re looking at a gradual process—think of it as a slow burn rather than a flash fire.

This means that price growth will probably stay pretty moderate for a while. No wild spikes, no sudden drops—just a steady pace as the market digests the current supply. It’s a bit like a long-distance race; we’re pacing ourselves rather than sprinting.

While the current market might be playing it cool, there's a longer game here. Today's ample listing inventory isn’t going to last forever. As demand eventually picks up, we need to think about what’s next. Building more homes is one piece of the puzzle, but it’s not just about throwing up condos like there’s no tomorrow. We need the right mix of homes, the ones that match what people actually need and, more importantly, can afford.

Municipalities can play a big role here by cutting down on development charges—the hidden costs that end up jacking up prices for buyers. If these prices don’t come down to earth, buyers might start looking elsewhere. And by "elsewhere," I don’t just mean the suburbs or the outskirts of the GTA. We could be talking about other provinces or even different countries.

So, what’s next for Toronto real estate? Expect things to remain relatively calm in the short term, with some possible shifts as lower mortgage rates slowly start to lure buyers back in. But don't expect an overnight transformation—this market is playing the long game. If you’re buying, selling, or just watching from the sidelines, keep an eye on these subtle changes. The landscape might look calm now, but there’s a lot going on beneath the surface.

Stay tuned, Toronto. This story isn’t over yet.

Let’s start with the facts: yes, home sales are down. But does this mean the market is crashing, burning, or otherwise imploding? Not quite. The number of new listings crept up a little, which means more homes are up for grabs. The market's staying well-stocked with options, so if you’ve been browsing, you might have noticed that the landscape looks pretty similar to last month. Prices? They’ve edged down a bit compared to last year. Nothing dramatic—just a little nudge lower.

What's Really Happening with Prices?

But here’s the twist: the Bank of Canada dropped a rate cut on September 4th, which is like tossing a pebble into a still pond. It’s not going to create a tidal wave immediately, but it’s going to ripple through the market in some interesting ways. Lower rates mean better affordability, especially for those clutching their variable-rate mortgages like a life raft. First-time buyers, this might be your moment. With borrowing costs set to trend downward for the rest of this year and into the next, we could see a new wave of buyers dipping their toes back in, particularly in the condo market.

The Calm Before the Storm

Now, just because we might see more buyers entering the scene doesn't mean we're about to witness a feeding frenzy. Even with demand picking up, there’s still plenty of inventory out there. So, while more buyers might jump in as mortgage rates become more attractive, they’re not going to gobble up everything overnight. We’re looking at a gradual process—think of it as a slow burn rather than a flash fire.

This means that price growth will probably stay pretty moderate for a while. No wild spikes, no sudden drops—just a steady pace as the market digests the current supply. It’s a bit like a long-distance race; we’re pacing ourselves rather than sprinting.

Why Supply Still Matters

While the current market might be playing it cool, there's a longer game here. Today's ample listing inventory isn’t going to last forever. As demand eventually picks up, we need to think about what’s next. Building more homes is one piece of the puzzle, but it’s not just about throwing up condos like there’s no tomorrow. We need the right mix of homes, the ones that match what people actually need and, more importantly, can afford.

Municipalities can play a big role here by cutting down on development charges—the hidden costs that end up jacking up prices for buyers. If these prices don’t come down to earth, buyers might start looking elsewhere. And by "elsewhere," I don’t just mean the suburbs or the outskirts of the GTA. We could be talking about other provinces or even different countries.

Looking Ahead

So, what’s next for Toronto real estate? Expect things to remain relatively calm in the short term, with some possible shifts as lower mortgage rates slowly start to lure buyers back in. But don't expect an overnight transformation—this market is playing the long game. If you’re buying, selling, or just watching from the sidelines, keep an eye on these subtle changes. The landscape might look calm now, but there’s a lot going on beneath the surface.

Stay tuned, Toronto. This story isn’t over yet.

Here are the most recent Toronto numbers...