So, here we are in August 2024, and it seems like the Toronto real estate market is finally waking up from its slumber. Last July, the market was sluggish, but this July? Let’s just say things got a bit more interesting. Home sales have ticked up compared to last year, which might make you think that the market is getting hotter. But before you start celebrating, let’s break this down.

Even though more people are buying homes, there’s still a lot more inventory on the market than there was last year. This means buyers have more options, and when buyers have more options, prices tend to cool off a bit. So, if you’re a buyer, you’re in a good spot. Sellers? Not so much. But don’t panic yet; the situation is a little more nuanced than that.

The Bank of Canada cut rates in June and July, and this seems to have lit a bit of a fire under the market. Lower rates mean cheaper borrowing, and cheaper borrowing means more people are ready to dive into the housing market. As we move through the year, it’s likely we’ll see even more action as those lower mortgage payments start to lure in the buyers who’ve been sitting on the fence.

But here’s where it gets tricky. Even though more buyers are jumping in, there’s a pretty hefty amount of inventory to wade through. This extra supply is keeping prices from shooting up – for now. But don’t get too comfortable. Once this inventory starts to dwindle, and unless we see a significant increase in new home completions, prices are going to start creeping up again. It’s that classic supply-and-demand dance we all know too well.

On the construction front, there’s talk about making it easier to build multi-family units in the city, which is great if you’re thinking long-term. More homes mean more choice and, hopefully, a little more balance in the market. Plus, with the Crosstown LRT finally inching closer to reality, we might see some positive shifts in how the city grows and connects.

In short, the Toronto real estate market is in an interesting place right now. Buyers have more choices, prices are staying relatively stable, and the future is looking a bit more optimistic – as long as you’re paying attention to the details. Keep an eye on the inventory, watch those mortgage rates, and stay tuned for what happens next. This market might just have a few more surprises in store.

Even though more people are buying homes, there’s still a lot more inventory on the market than there was last year. This means buyers have more options, and when buyers have more options, prices tend to cool off a bit. So, if you’re a buyer, you’re in a good spot. Sellers? Not so much. But don’t panic yet; the situation is a little more nuanced than that.

The Bank of Canada cut rates in June and July, and this seems to have lit a bit of a fire under the market. Lower rates mean cheaper borrowing, and cheaper borrowing means more people are ready to dive into the housing market. As we move through the year, it’s likely we’ll see even more action as those lower mortgage payments start to lure in the buyers who’ve been sitting on the fence.

But here’s where it gets tricky. Even though more buyers are jumping in, there’s a pretty hefty amount of inventory to wade through. This extra supply is keeping prices from shooting up – for now. But don’t get too comfortable. Once this inventory starts to dwindle, and unless we see a significant increase in new home completions, prices are going to start creeping up again. It’s that classic supply-and-demand dance we all know too well.

On the construction front, there’s talk about making it easier to build multi-family units in the city, which is great if you’re thinking long-term. More homes mean more choice and, hopefully, a little more balance in the market. Plus, with the Crosstown LRT finally inching closer to reality, we might see some positive shifts in how the city grows and connects.

In short, the Toronto real estate market is in an interesting place right now. Buyers have more choices, prices are staying relatively stable, and the future is looking a bit more optimistic – as long as you’re paying attention to the details. Keep an eye on the inventory, watch those mortgage rates, and stay tuned for what happens next. This market might just have a few more surprises in store.

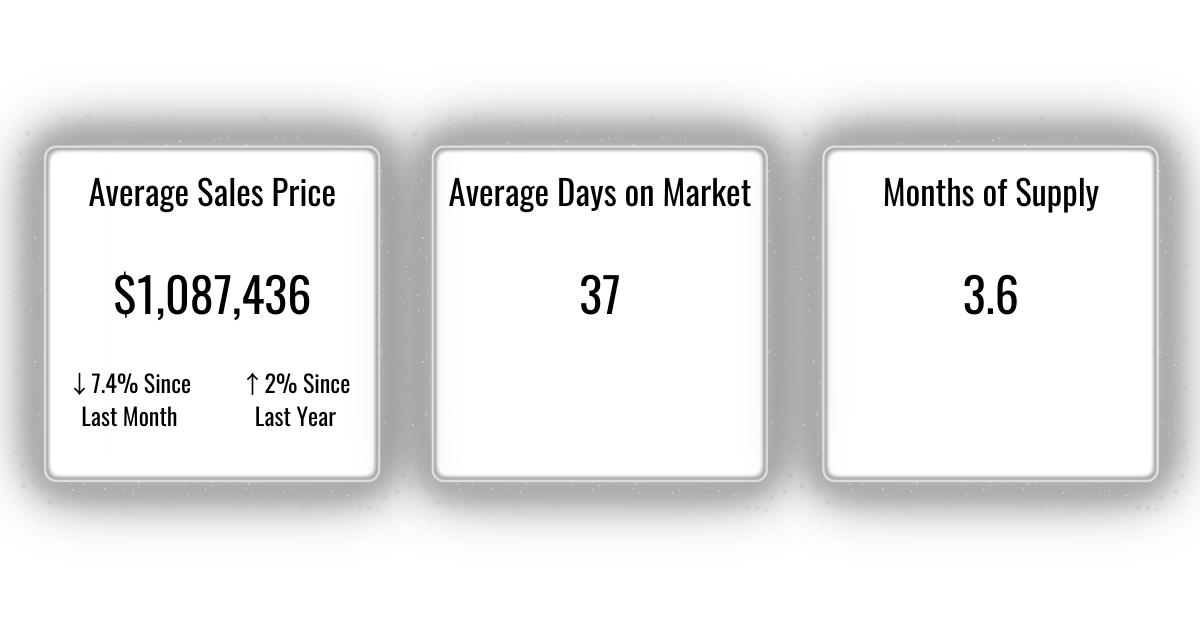

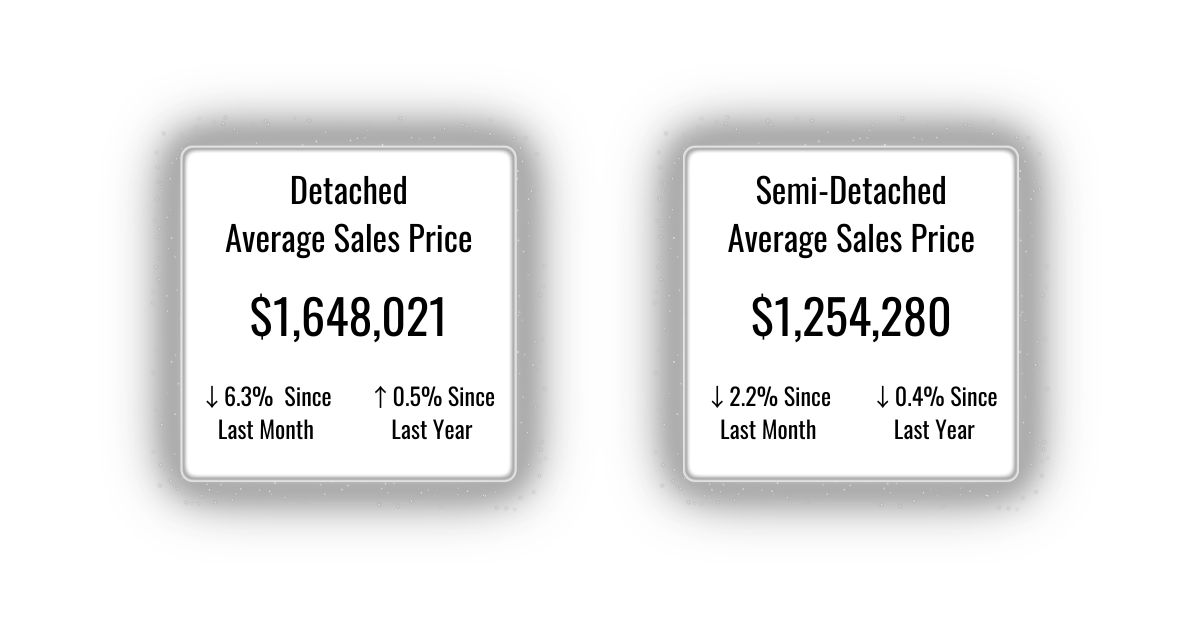

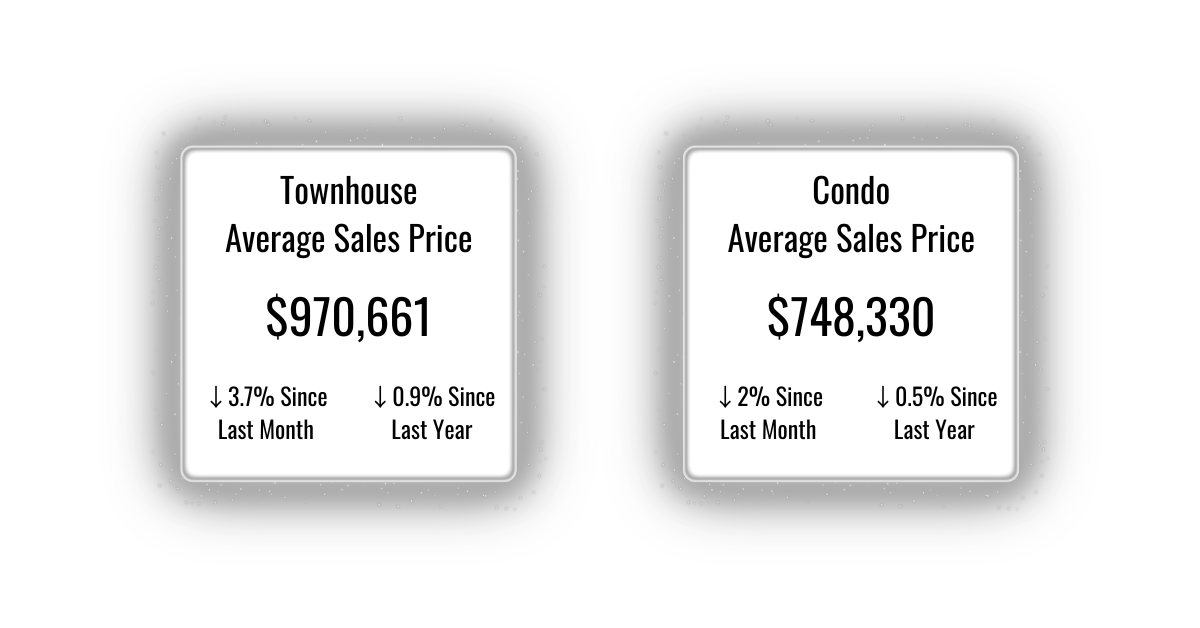

Here are the most recent Toronto numbers...