The unwelcome guests of inflation and borrowing costs have crashed our housing party. Affordability has taken a hit, particularly in the interest rate-sensitive housing niche. But hold on – there's a glimmer of hope. Bond yields are gracefully gliding to a lower rhythm, and whispers of Bank of Canada rate cuts in 2024 are like the DJ signaling a change in tempo. Lower rates might just be the lifeline that homeowners and eager buyers have been waiting for.

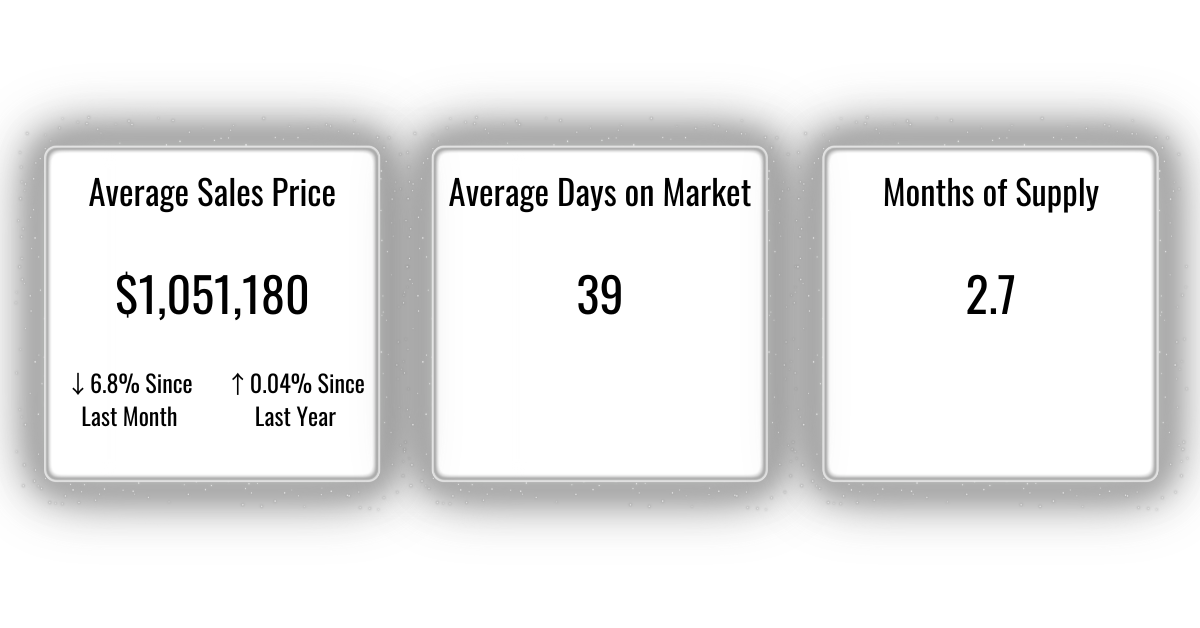

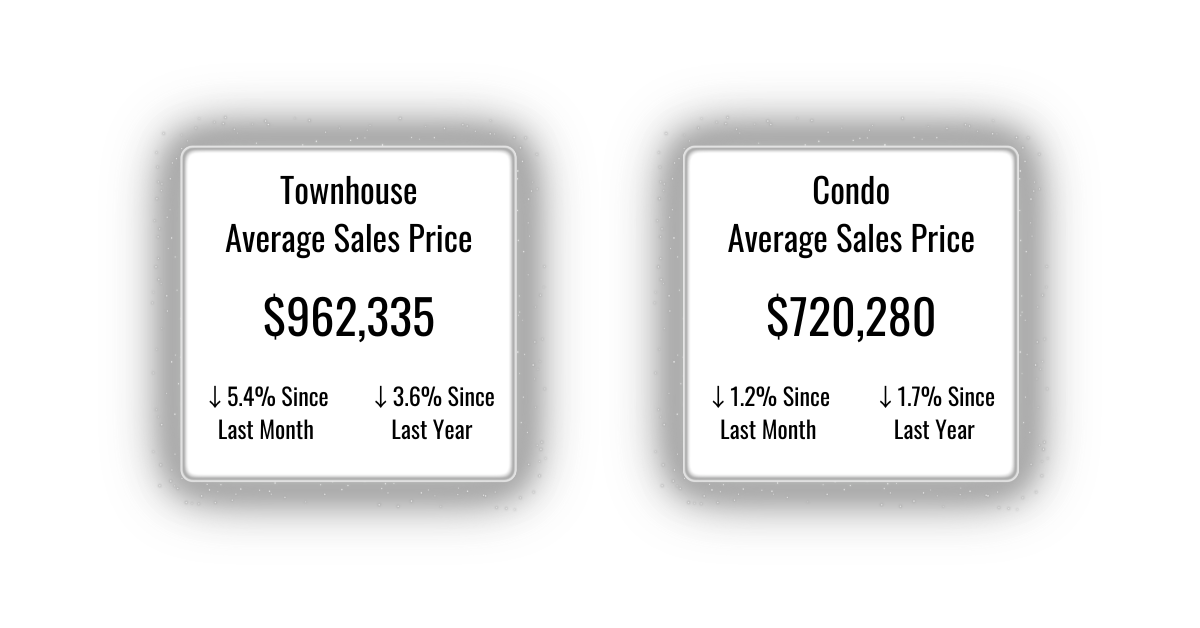

Now, let's dive into the digits without getting too bogged down. The MLS® Home Price Index Composite benchmark and the average selling price have decided to keep it cool, akin to Toronto's November weather – essentially flat. On a monthly basis, they're feeling a bit of the seasonal blues, with a slight dip.

Prices have taken a step back, catching their breath from the high-flying days. Good news for those eyeing the market with dreams of a cozy home. As mortgage rates play limbo in the coming year and our population continues its growth spurt, demand is likely to show up fashionably late, sparking a fresh rhythm in home prices.

A lot of voices are rallying for housing affordability. There have been some commendable policy moves, like allowing existing insured mortgage holders to switch lenders stress-test-free. And wouldn't it be a delightful melody if the same approach applied to uninsured mortgages? Just some food for thought.

In the grand scheme of things, we're witnessing a growing demand for homes, both to nest in and to rent. And, of course, more supply is needed. So, as we conclude 2023, keep an eye on the real estate dance floor. It might just be gearing up for a show-stopping 2024!

Here are the most recent Toronto numbers...