As we dive into the Toronto real estate scene in November 2023, it's clear that both challenges and opportunities are on the horizon. For those in the Greater Toronto Area (GTA), the real estate market continues to be a topic of conversation. Let's take a closer look at what's been happening.

Affordability Concerns Persist

One of the ongoing issues that potential homebuyers have been facing is the lack of affordability. In October 2023, this concern remained at the forefront, and it had an impact on sales figures compared to the previous year. While it's true that sales have edged lower, it's essential to note that this trend doesn't tell the whole story.

Prices Holding Strong

Despite the dip in sales, selling prices have remained higher than last year's levels. This is due, in part, to the record population growth and a resilient GTA economy. The demand for housing remains robust, but an interesting shift is occurring. More of this demand is now directed towards the rental market.

High borrowing costs and uncertainty about interest rates have led many potential homebuyers to adopt a "wait-and-see" approach in the short term. However, experts believe that when mortgage rates start trending lower, home sales will pick up quickly. The market's adaptability and resilience are noteworthy.

TRREB President Paul Baron emphasizes this point, stating, "Record population growth and a relatively resilient GTA economy have kept the overall demand for housing strong. However, more of that demand has been pointed at the rental market, as high borrowing costs and uncertainty on the direction of interest rates has seen many would-be home buyers remain on the sidelines in the short term. When mortgage rates start trending lower, home sales will pick up quickly."

Price Trends

In October 2023, the MLS® Home Price Index Composite benchmark and the average selling price were both up on a year-over-year basis. These figures increased by 1.4 percent and 3.5 percent, respectively. On a seasonally adjusted basis, the MLS® HPI Composite benchmark saw a slight dip compared to September 2023, while the average selling price remained stable. Both the MLS® HPI Composite benchmark and average price stayed above the cyclical lows experienced earlier in the year.

TRREB Chief Market Analyst Jason Mercer notes, "Competition between buyers remained strong enough to keep the average selling price above last year's level in October and above the cyclical lows experienced in the first quarter of this year. The Bank of Canada also noted this resilience in its October statement. However, home prices remain well below their record peak reached at the beginning of 2022, so lower home prices have mitigated the impact of higher borrowing costs to a certain degree."

Concerns for Uninsured Mortgage Holders

In the current environment of extremely high borrowing costs, there is a concern for uninsured mortgage holders reaching the end of their current term. For those looking to explore more competitive rates, the qualification process remains a significant hurdle. Borrowers are still required to qualify at rates approaching eight percent, which can be an unrealistic barrier.

TRREB CEO John DiMichele raises this issue, saying, "In the current environment of extremely high borrowing costs, it is disappointing to see that there has been no relief for uninsured mortgage holders reaching the end of their current term. If these borrowers want to shop around for a more competitive rate, they are still forced to unrealistically qualify at rates approaching eight percent. Following their most recent round of consultations, the Office of the Superintendent of Financial Institutions should have eliminated this qualification rule for those renewing their mortgages with a different institution."

In summary, the Toronto real estate market continues to be influenced by affordability concerns, high borrowing costs, and shifting demand towards the rental market. Despite these challenges, prices have held strong, and the market remains adaptable. It's essential for potential buyers and sellers to stay informed and make decisions that align with their specific circumstances.

Affordability Concerns Persist

One of the ongoing issues that potential homebuyers have been facing is the lack of affordability. In October 2023, this concern remained at the forefront, and it had an impact on sales figures compared to the previous year. While it's true that sales have edged lower, it's essential to note that this trend doesn't tell the whole story.

Prices Holding Strong

Despite the dip in sales, selling prices have remained higher than last year's levels. This is due, in part, to the record population growth and a resilient GTA economy. The demand for housing remains robust, but an interesting shift is occurring. More of this demand is now directed towards the rental market.

High borrowing costs and uncertainty about interest rates have led many potential homebuyers to adopt a "wait-and-see" approach in the short term. However, experts believe that when mortgage rates start trending lower, home sales will pick up quickly. The market's adaptability and resilience are noteworthy.

TRREB President Paul Baron emphasizes this point, stating, "Record population growth and a relatively resilient GTA economy have kept the overall demand for housing strong. However, more of that demand has been pointed at the rental market, as high borrowing costs and uncertainty on the direction of interest rates has seen many would-be home buyers remain on the sidelines in the short term. When mortgage rates start trending lower, home sales will pick up quickly."

Price Trends

In October 2023, the MLS® Home Price Index Composite benchmark and the average selling price were both up on a year-over-year basis. These figures increased by 1.4 percent and 3.5 percent, respectively. On a seasonally adjusted basis, the MLS® HPI Composite benchmark saw a slight dip compared to September 2023, while the average selling price remained stable. Both the MLS® HPI Composite benchmark and average price stayed above the cyclical lows experienced earlier in the year.

TRREB Chief Market Analyst Jason Mercer notes, "Competition between buyers remained strong enough to keep the average selling price above last year's level in October and above the cyclical lows experienced in the first quarter of this year. The Bank of Canada also noted this resilience in its October statement. However, home prices remain well below their record peak reached at the beginning of 2022, so lower home prices have mitigated the impact of higher borrowing costs to a certain degree."

Concerns for Uninsured Mortgage Holders

In the current environment of extremely high borrowing costs, there is a concern for uninsured mortgage holders reaching the end of their current term. For those looking to explore more competitive rates, the qualification process remains a significant hurdle. Borrowers are still required to qualify at rates approaching eight percent, which can be an unrealistic barrier.

TRREB CEO John DiMichele raises this issue, saying, "In the current environment of extremely high borrowing costs, it is disappointing to see that there has been no relief for uninsured mortgage holders reaching the end of their current term. If these borrowers want to shop around for a more competitive rate, they are still forced to unrealistically qualify at rates approaching eight percent. Following their most recent round of consultations, the Office of the Superintendent of Financial Institutions should have eliminated this qualification rule for those renewing their mortgages with a different institution."

In summary, the Toronto real estate market continues to be influenced by affordability concerns, high borrowing costs, and shifting demand towards the rental market. Despite these challenges, prices have held strong, and the market remains adaptable. It's essential for potential buyers and sellers to stay informed and make decisions that align with their specific circumstances.

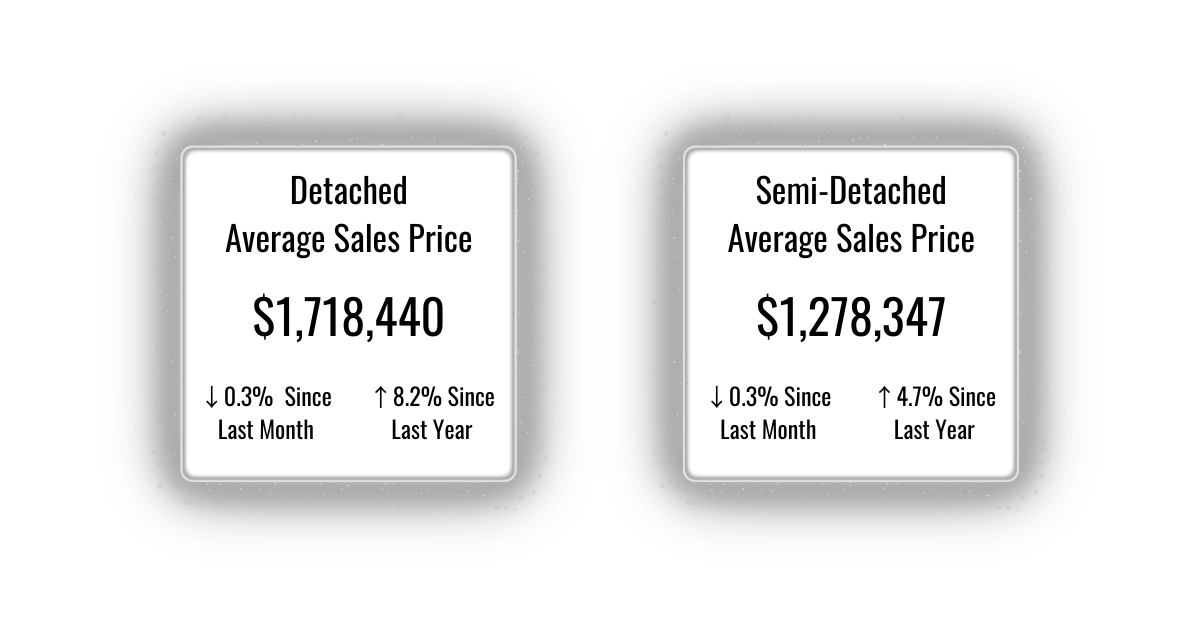

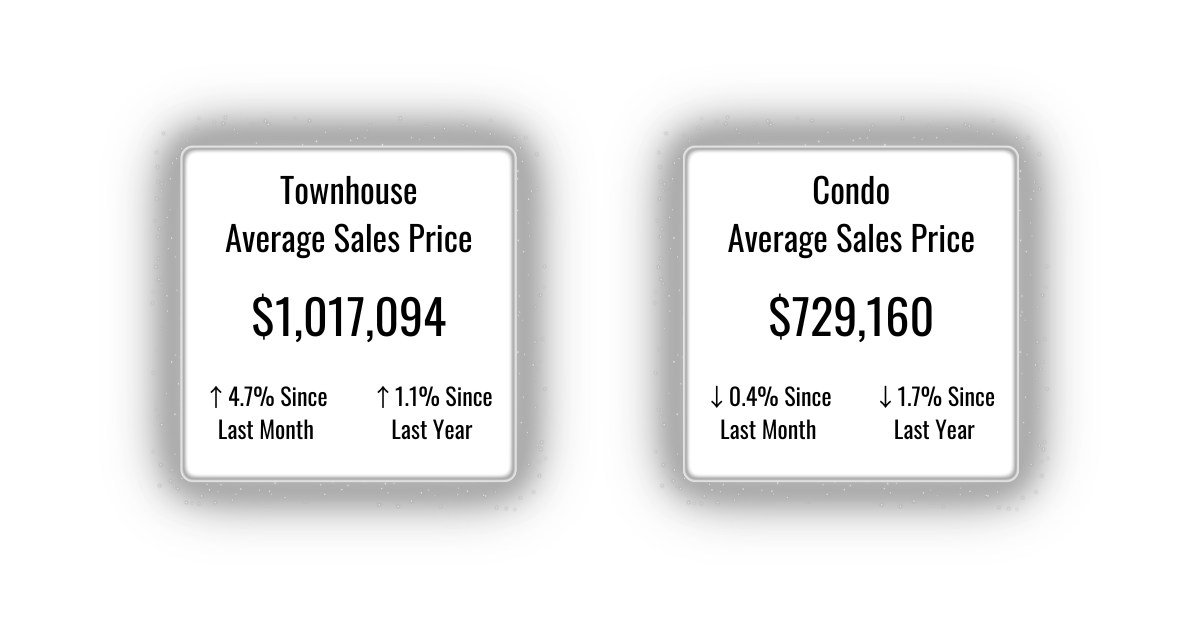

Here are the most recent Toronto numbers...