The Greater Toronto Area housing market experienced a significant adjustment in 2022, following record levels in 2021. The market was plagued by existing affordability issues, brought on by a lack of housing supply, which were further exacerbated by sustained interest rate hikes by the Bank of Canada.

"Following a very strong start to the year, home sales trended lower in the spring and summer of 2022, as aggressive Bank of Canada interest rate hikes further hampered housing affordability. With no relief from the Office of Superintendent of Financial Institutions (OSFI) mortgage stress test or other mortgage lending guidelines including amortization periods, home selling prices adjusted downward to mitigate the impact of higher mortgage rates. However, home prices started levelling off in the late summer, suggesting the aggressive early market adjustment may be coming to an end", said new Toronto Regional Real Estate Board President Paul Baron.

"While home sales and prices dominated the headlines in 2022, the supply of new listings continued to be an issue as well. The number of homes listed for sale in 2022 was down in comparison to 2021. This helps explain why selling prices have found some support in recent months. Lack of supply has also impacted the rental market. As renting has become more popular in this higher interest rate environment, tighter rental market conditions have translated into double-digit average rent increases," said TRREB Chief Market Analyst Jason Mercer.

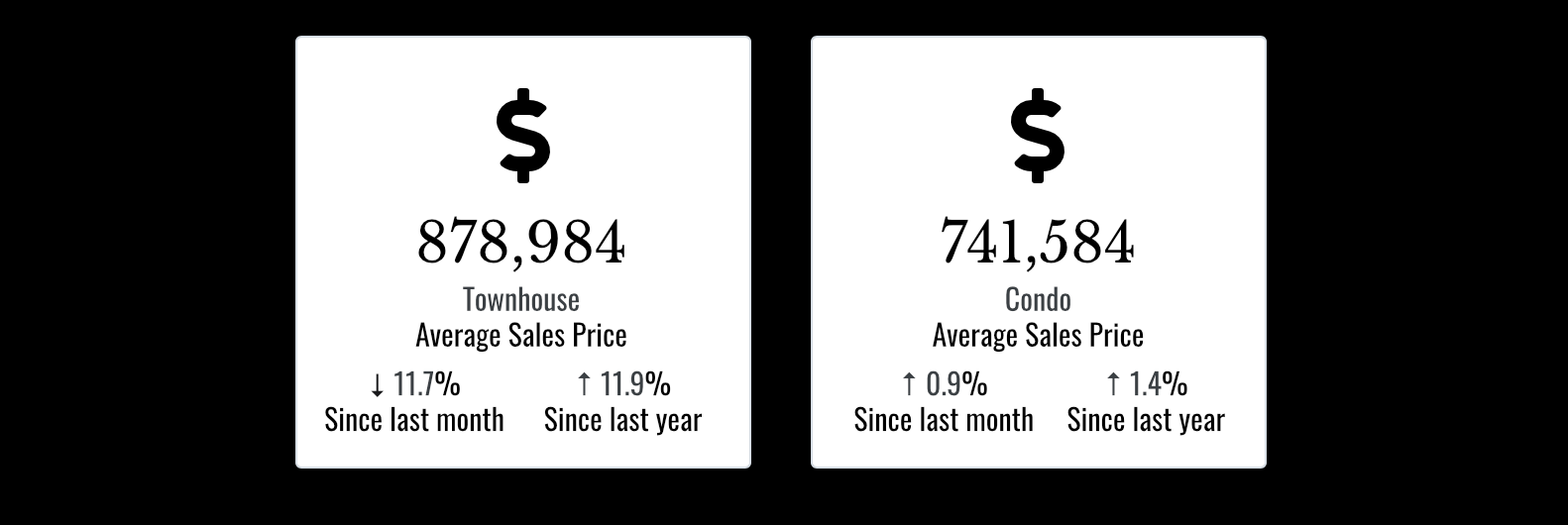

Here are the Toronto numbers...